10 Sep Investment Markets Update – September 2020

1st September 2020

Investment Markets Update

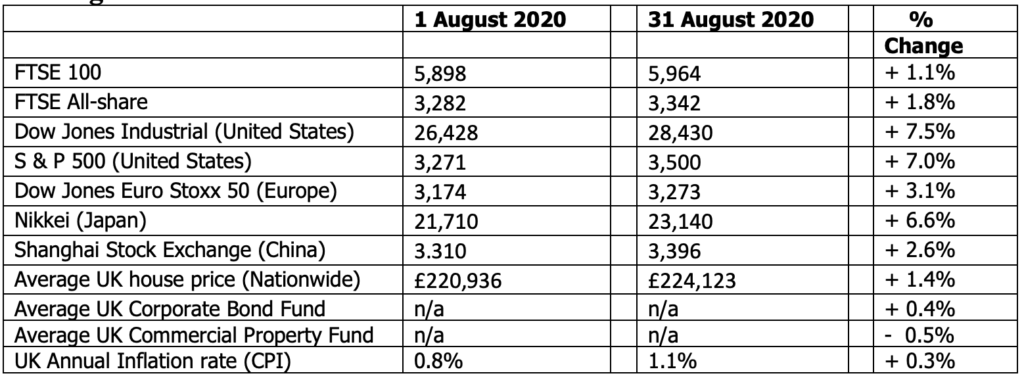

The figures:-

The reasons:-

As the Coronavirus pandemic continues to dominate world affairs, August saw further rises in world stock markets. The Developed Market Index rose by 6.7% in August alone. This extremely high rate of growth in stock prices was pulled along in particular by US Shares, which benefited from higher than expected second Quarter results and good forward indicators for both manufacturing and service industries, with Purchasing Managers Indices (PMI’s) significantly higher than had been anticipated. These results and indicators have been partly helped by the stimulus measures introduced by the US Federal Reserve in March and also benefiting from market expectations that a further stimulus package will be forthcoming. With the Presidential elections just a few months away, we can be sure that efforts will be made on the President’s behalf to increase further economic support, which could raise stock prices higher still. That said, it is very noticeable that whilst the United States continues a real battle against COVID-19, and the economy having to be effectively frozen for several months, the S&P 500 has already reached a record all-time high during August, with Technology stocks being the main beneficiaries. Perhaps the most extraordinary figure was that of Amazon founder and shareholder Jeff Bezos who saw the value of his own company’s shares increase by $13 BILLION – in just one day in July! The big question is – have markets recovered too far, too quickly? Markets look ahead 6-12 months, but the Nasdaq Index (US technology index) has gained so much ground in recent times that the chance of a sell-down seems to be increasing.

Looking at Europe, further gains were added to the already encouraging recovery we have seen in stock prices over the last few months. Markets continue to be happy that the European Central Bank (ECB) have got their act together and will push through the significant EU recovery fund promised a few months back.

I am afraid to report that the United Kingdom continues to be the laggard in terms of stock prices this year, in the developed world. The Lockdown period lasted longer here than in other parts of Europe and this produced significantly worse results in the second Quarter than almost all other European economies. That said, June showed the highest growth in a single month on record and my expectation is that July and August will continue in a similar vein. There was widespread agreement that Chancellor Sunak’s “Eat Out To Help Out” scheme was highly successful, certainly in terms of bringing the punters into restaurants and getting a proportion of the population back into the swing of venturing into outdoor activity, to a certain extent at least.

Furthermore, although UK stock prices remain subdued, there is further evidence of the latest housing price boom. The Nationwide reported the highest ever recorded house price values in August as buyers competed with each other to take advantage of the temporary stamp duty cut and, probably, some pent-up demand from earlier in the year when house purchases and rental moves were put on ice.

For what it’s worth, I still believe that we are likely to see a fairly v-shaped recovery in this country, particularly with the stimulus packages already announced and – quite possibly – others to follow. That said, there is no doubt that although certain industries have boomed from the Lockdown period (such as supermarkets, home delivery companies etc.) other areas of the economy have been fairly decimated, in particular the hospitality, retail and airline industries, as well as some good manufacturing businesses. There is little doubt that with the furlough scheme now tapering off, the risk of a high jump in unemployment is real. This would certainly provide a significant headwind to economic recovery during this year and beyond.

Over in China, the economy is continuing to recover – remember that the pandemic hit there sooner than here – but although production has moved into a recovery position, household consumption is yet to follow the same trajectory, perhaps as a result of the Chinese Government not providing stimulus packages or personal incentives as we have seen in the UK and other Western economies.

So, in conclusion, I am able to report that, in general, stock markets around the world are continuing to recover strongly. Those big losses investors were nursing in the spring have been mostly erased. Had you embarked on a trip to Mars last August and just got back today, and checked your pension fund values (as you would, of course), you’d barely notice anything had happened whilst you were away. Perhaps that would have been a good plan!

Jargon Buster – BED & ISA

Many of our clients have non-pension fund investments, some of which are in an ISA Tax Wrapper and other investments that are in a General Investment Account (GIA), from which each year we can move £20,000 from the GIA, and into the ISA to increase the tax efficiency of the portfolio. Depending on the Administrator or Platform used, investors may see reference to “BED & ISA”. To the layman, this all frankly means nothing at all. I thought therefore I might take the opportunity to explain why this particular piece of jargon still exists in the investment world.

In years gone by, some investors and stockbrokers were in a habit of selling shares on the final day of the tax year, 5 April and re-purchasing the very same shares the next day, the start of the new tax year. The purpose of this was to take advantage of the Annual Capital Gains Tax (CGT) allowance and avoid paying tax on the gain made on those shares in the previous year and having the advantage of starting the next tax year with a higher starting price upon which to base future Capital Gains Tax calculations. This very short term sale of shares one evening and the re-purchasing of the same shares the next morning was known as “Bed & Breakfasting”. The Government eventually got fed up of such blatant tax avoidance practices and introduced a 30 day window, during which time if the same shares you had sold were repurchased in that time, then the original sale was ignored and for CGT purposes you were assessed on the original purchase price not the updated value. This meant that investors trying to gain some tax advantage then took the investment risk of no longer being in the market for at least one month and thus the practice effectively stopped.

However, the sale of investments up to £20,000 for the purpose of reinvesting into the same assets within an ISA wrapper is not really affected by this change, because once the funds are in the ISA wrapper there is no liability to Capital Gains Tax after that. If you are able to utilize your CGT allowance when selling up to £20,000 of assets from your GIA in order to fund your ISA investment then that is a further advantage still.

For this reason, some organizations within the investment industry still refer to the old fashioned jargon and use the term “BED & ISA” as shorthand for selling assets in a General Investment Account and repurchasing immediately the same assets within the more tax efficient ISA wrapper.

Please note these are the views of Christopher Charles Financial Services Ltd, and are for background information only. They do not constitute advice, nor should action be taken without specific advice, pertaining to individual circumstances. Investments can fall as well as rise in value, and you may not get back as much as you invested, particularly in the short term. E & O E – figures are produced with great care, but no liability whatsoever can be accepted for any errors of information within this document. Past performance is not a guide to the future. Christopher Charles Financial Services Ltd is authorised and regulated by the Financial Conduct Authority.

CCFS Ltd, The Dolls House, Teeton Road, Guilsborough, Northampton, NN6 8RB Phone: 01604 740022