31 Aug Investment Markets Update – July 2021

1st July 2021

Investment Markets Update

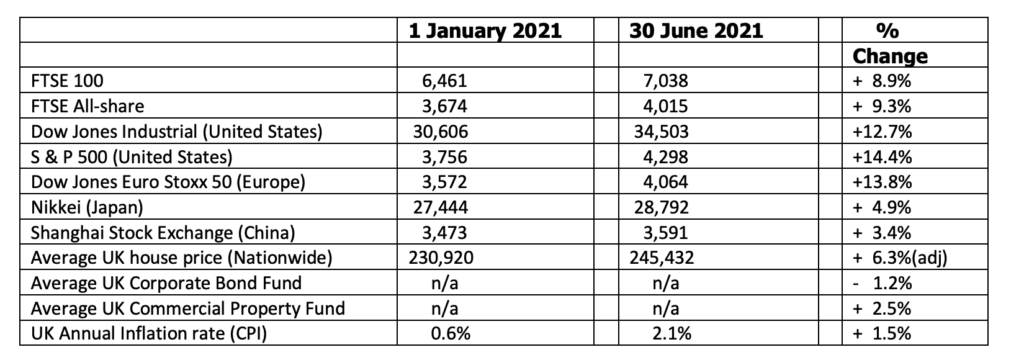

The figures:-

The reasons:-

I thought this month would be an opportune time to compare markets as they stand now with how they began the year, six months ago. The first thing you will see is that Equity markets are all up, across the world, from 1 st January. In some cases, they are up very strongly indeed. Leading the recovery this year has been the United States with share prices up around 14%. Continental Europe has more or less matched these returns whilst even the United Kingdom, unloved for several years now, has returned gains of around 9% since the start of the year. Mid-Cap and smaller UK Equities have performed particularly strongly.

Asian markets, including China and Japan, have made gains also, albeit rather more modest.

Even Commercial Property investments, which suffered an annus horribilis in 2020, has seen a steadying of asset prices. Investment funds that were suspended for trades have almost all reopened, and markets seem to feel they might have reached their nadir. The only major asset class that has not made gains this year has been in the UK Corporate Bond market, as fears of rising inflation (which would inevitably lead to a reduction in quantitative easing and/or the rise in interest rates) has weighed down the sector.

And so, at the halfway stage, the School Report for investment markets across the globe is generally a very satisfactory one indeed. However, we remain in very unusual and uncertain times.

Across the western world the COVID vaccine programme is being rolled out at a pace and restrictions on citizens and businesses are, as a result, being wound down. Economic activity is rising as a result with the UK economy, as an example, expected to have its strongest years growth since 1941. Of course, just like then, those figures follow the very substantial drops in GDP in the previous year (this time due to COVID, back then due to the start of World War II).

What has become clear, in the UK and the rest of the developed markets, is that there is most certainly a V shaped recovery that many people, including myself if I might say, anticipated last year. Halfway through 2021 and the UK GDP currently stands around 3% lower now than it did at the start of 2020. Unless take things take a very nasty turn for the worse (which is always possible) then I would expect to see the UK economy reaching a record size by the end of this year, totally wiping out the GDP falls we saw in 2020. For many reasons, the “V” has been steeper, both down and up, in the UK than in continental Europe or North America. This is partly due to the UK economy’s reliance on the service sector, which was particularly badly hit in such areas such as hospitality, airlines etc. There were, however, further factors at play such as the fact that the UK GDP includes school attendance which some countries do not include within their measurements. Therefore, with schools being closed for many months, GDP falls in the UK appeared particularly large. By the same metric, the recovery now is seen as rather greater due to the fact that that pupils are now mostly back in school.

Hidden behind this potentially great recovery lies, of course, risks. In addition to the risk of new variant mutations of Covid, there is also a realistic risk of inflation moving well ahead of targets. In the UK, the Bank of England has a target of 2% inflation and if it falls below or above 1% of that figure then the Governor of the Bank of England is required to write to the Chancellor of the Exchequer explaining why this has happened and what they intend to do about it. There is general agreement within the Bank of England that inflation is going to move to over 3% by the end of the year. However, when the Governor puts ink in his pen to write to the Chancellor explaining this, he currently thinks that he will be able to reassure Chancellor Sunak that the inflation rise is only temporary. The Bank of England, at this stage, remains confident that inflation would then drop back towards the target figure of 2% during 2022.

This all sounds very motherhood and apple pie, but not everybody agrees with this reassuring outlook. Andy Holdane was the Chief Economist at the Bank of England and on the Monitory Policy Committee until 30 June. One of the more blunt and plain speaking members of the MPC, Mr Holdane has made clear his views that inflation is a real risk and could run far higher than the economy could reasonably take. At the last MPC meeting that he was involved in, Mr Holdane voted to reduce quantitative easing and signalled that he thought a rise in interest rates would be necessary rather than later. He was, however, a lone voice and the MPC voted to continue with the existing QE programme and retained interest rates at the historical low rate 0.1% without giving any indication that that would change any time soon.

Obviously, most economists would hope that Andy Holdane is incorrect and the rest of the MPC members were right (though savers might welcome a rise in interest rates). However, with news of shortages of HGV drivers and other key industry workers, there is anecdotal evidence at least that wages are being increased. With other complications being introduced due to COVID restrictions and in some cases Brexit changes, there is a very plausible scenario one could paint for predicting higher than expected inflation. If this were to happen, the Bank of England may be forced to slam on the economic brakes by way of reducing the QE programme and/or raising interest rates. It is noticeable that whenever data comes out that suggests this scenario might indeed occur, stock markets get into a frightful lather and fall by 1% or even 2% in a day. So far, however, whenever this has occurred nerves have stabilised soon afterwards and markets recovered accordingly. Should inflation fears prove founded, and QE reduced or interest rates raised, there is the risk of a more lengthy fall in markets.

There remains significant uncertainty about whether we are at the beginning of the end of the pandemic, certainly so as far as the western world is concerned. Some indications are that we may indeed be in that position and the vaccines will hold good, perhaps with the requirements for further boosters for populations over the years ahead. However, other commentators point to the fact that much of the world remains largely unvaccinated and the risk of mutant variations, resistant to current vaccines, poses risks for us all and that we are by no means certain to have reached the end of this journey yet. And so, there could be many twists and turns yet as far as economic activity is concerned, depending upon how the COVID pandemic pans out from here.

At the best of times it is almost impossible to predict for certain which asset classes are going to do best in the next year or so. I have attached a document which I have sent in previous years, which I call the “Patchwork Quilt of Investments.” My thanks to 7IM for the latest document. You will see how, over the last 15 years, which broad asset classes have done best in any particular year, and those that have done worst. As can be clearly seen, results vary greatly from one year to the next. There is no discernible pattern. Over the longer term, we can reasonably expect Equities to produce more than Bonds which in turn should produce more than Cash. Over more immediate timescales, such as one or two years, the pattern is random indeed. It is for that reason that investment advisors repeat the mantra of diversification and a wide spread of investments for longer term investors wanting to avoid particularly high and low roller coaster returns.

Link to download the Patchwork Quilt of Investments doc.

Jargon Buster – Business Property Relief – How it can help investors and reduce inheritance tax

Business Property Relief (BPR) was introduced in 1976. The main aim was to ensure that after the death of the owner, a family-owned business could survive as an on-going trading entity, without needing to be sold or broken up to pay for an Inheritance Tax (IHT) liability. Over the last few decades, Governments have subsequently encouraged people to invest in trading business, regardless of whether they run the business themselves or not. Not all business qualify for BPR, but it will usually apply to shares in unquoted companies, partnerships or shares in a qualifying company listed on the Alternative Investment Market (AIM). AIM listed shares can now be held within a tax efficient ISA to boot.

For Inheritance Tax Planning, BPR-qualifying investments can be an excellent tool. A major incentive is that investments need only be held for just two years to be considered outside of the Estate for IHT purposes. The usual timescale for IHT relief by way of Gifts or investments into Trusts of seven year is thus greatly speeded up.

Secondly, an investor retains the ownership of the BPR investment and is able to recall the money for their own needs should they wish to (although of course that would immediately bring back the asset into the owner’s Estate).

Thirdly, such investments do not count towards the Nil Rate Band IHT Allowance, meaning that other assets such as a Main Home can utilise the Nil Rate Band allowance, on top of the BPR qualifying assets. Fourthly, these investments are straightforward to invest in and avoid the complexity and possible costs of Trusts or the loss of control of making an outright Gift.

It should be noted that BPR qualifying investments are, by nature, higher than average risk and will not be suitable for everybody. Nevertheless, for individuals with significant assets, concerned about Inheritance Tax liability this sort of investment is increasingly mainstream, (particularly with the permission to now invest via ISA’s) and may certainly be an option worth considering for some.

Please note these are the views of Christopher Charles Financial Services Ltd, and are for background information only. They do not constitute advice, nor should action be taken without specific advice, pertaining to individual circumstances. Investments can fall as well as rise in value, and you may not get back as much as you invested, particularly in the short term. E & O E – figures are produced with great care, but no liability whatsoever can be accepted for any errors of information within this document. Past performance is not a guide to the future. Christopher Charles Financial Services Ltd is authorised and regulated by the Financial Conduct Authority.

CCFS Ltd, The Dolls House, Teeton Road, Guilsborough, Northampton, NN6 8RB Phone: 01604 740022