01 Jul Investment Markets Update – July 2020

1st July 2020

Investment Markets Update

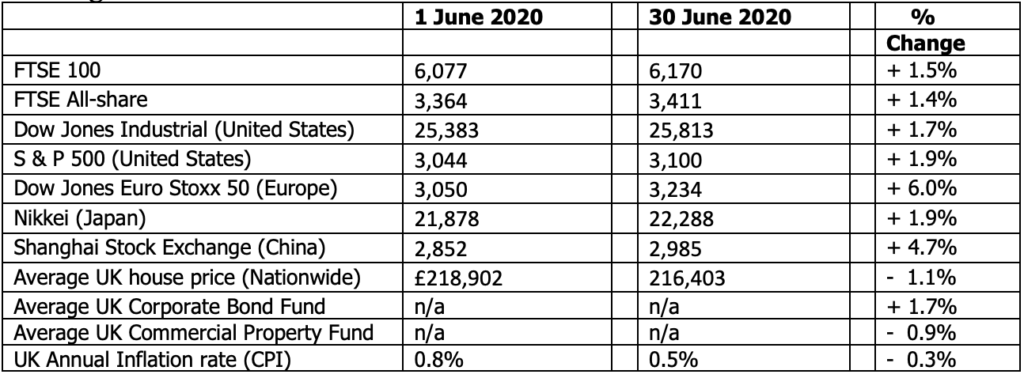

The figures:-

The reasons:-

So far this year, stock markets have somehow adroitly followed the changing seasons very closely. After the dark days of the February/March Coronavirus-market misery of late winter, Spring then sprung, with record levels of sunshine-hours and stock markets similarly basking in a warm glow of light and renewal also. The second Quarter of 2020 was the best Quarterly returns seen in world stock markets for over a decade. They rose by some 18% in those three months, helped in particular by the USA – which saw its best stock market quarter since 1998 – and Germany that made an excellent 24% gain in 3 months. We’re still not yet back to the high points seen in January of this year, but much of the falls seen in February/March have since been recovered.

As Warren Buffett once said, it is wise for investors to be “fearful when others are greedy, and greedy when others are fearful.” A few of our clients were brave enough to add to their investments at the bottom of the market (well done them!), but – more importantly – none panicked and sold out at the low point. I’m delighted about that – remember, it was just 3 months ago that the FTSE 100 fell to 4,900. We took many calls and emails, of course, and I was at pains to try to put this crises in the context of long term market movements, and the ups and downs that are a feature of markets – including, sometimes, very unpleasant and wild volatility. I am, therefore, pleased to report such a positive Quarter, which has brought significant relief to our investors. We are not yet out of the woods of course, and further downturns are possible, but I’m very happy to present some positive figures again.

Readers may note that these extraordinarily good figures are not front page news in the papers. You might not even be aware of just how well markets have done in the last 3 months. Be assured, had the markets gone down by the same levels it would have been top of every news bulletin for a week!

There is a serious point to that. It’s well known that national media prefer to take the negative stories over the positives. We all allow for that in our thinking when we see/hear the news. But sometimes, even when filtering the news we hear, we can get a distorted picture. Furthermore, some clients – depending on the technical structure of their investments – received a mandatory “10% drop in your portfolio” letter this year, from their investment managers. Since then, they will have benefitted from a 10% gain in their portfolio – but no letter will have been sent celebrating that fact! The 10% drop letter is an EU requirement that the UK “retail” market wasn’t really the intention for, so I hope it gets dropped as soon as possible after the current EU “transition period” ends in December.

Looking at some of the different markets, the UK FTSE 100 has made a recovery of a relatively modest 9% since 1st April, and is currently one of the laggards of the developed worlds’ stock markets, mainly as a result of being one of the Covid 19 hardest-hit countries (although the evenmore-Covid-badly-hit-USA markets are seemingly ignoring their own local problems. The culture there of “never mind the world, the economy must go on” attitude plus the enormous Fiscal stimulus provided by the Federal Reserve means markets have gone from outright fear to positive optimism in just a few short months).

The UK and European markets in particular do seem to predispose that there will not be a significant spike from a second wave of COVID-19 across the developed world – a real unknown and a risk that could still send markets spiralling down again in the future.

But for now, optimism is once again the order of the day. We have even seen the Eurozone countries put together a fiscal stimulus using the EU institutions as a mechanism to get money to the most heavily-hit southern European countries such as Spain and Italy. There is a risk that a recent German court ruling could at least partly scupper this coming plan, but for now it does appear that peace has broken out across the Eurozone and there is hope that the economies within that can now make a recovery. The Eurozone was the star market performer in June, as a result of this fiscal action, in addition to the easing of lockdown throughout the region.

Here in the UK we find ourselves in a not dissimilar position. People are slowly being allowed to return to a slightly more normal way of life, albeit with the social distancing restrictions we are becoming used to. As a result, there is increasing hope of a “V” shaped recovery. By this, we mean that following the very sharp descent of the economy’s fortunes earlier this year, there could be a similar strong rise as things rebound quickly. As I say, given the risk of a second wave of Coronavirus, this cannot be banked upon but it is certainly a thought for optimism. There is plenty of anecdotal evidence that there is pent-up demand in certain sectors. Rental property activity seems to have quickly got back into gear and there is a general clamour for hospitality and tourism facilities to be opened up. It seems that the British people are desperate to enjoy a pint in the beer garden soon, and I personally think we will see a very quick and strong pick-up in the service sector, as soon as things are allowed to open again.

The government has given further detail on its Furlough scheme, which again was generally well received. Criticism to date has mainly been on the handling of medical issues, and not on the governments’ handling of the economic challenges. A tapered ending to Furlough, rather than a cliff-edge, is the plan, although the real test comes when some businesses decide that they will be unable to avoid redundancies as the scheme does taper out. Significant increases in unemployment remains a real risk.

Inflation fell to just 0.5% last month. This was as a direct result of falling oil prices and a general large scale reduction in demand due to the effective shutting down of the economy in April for public health reasons. The Bank of England’s inflation target is 2% per annum and should inflation be 1% higher or lower than that amount, then the Governor of the Bank of England is required to write a letter to the Chancellor of the Exchequer explaining why inflation is outside of that target band and what the Bank of England intends to be about it. Well, of course it is obvious why inflation has fallen so low and it looks unlikely that inflation will be a problem in the foreseeable future given the deep recession that we are currently going through (even though the figures for the 2nd Quarter won’t be published for some time yet). 3 rd Quarter 2020 will undoubtedly see the one of the largest recoveries in the economy ever seen, but how quickly any of that will filter through into inflation remains to be seen. Right now, inflation isn’t on anybody’s radar.

As a result of the low inflation and low interest rates that are going alongside this, history was made at the end of April. The Government made a successful sale of £3.8bn of three year Bonds at an interest rate of -0.003%. This means that any individual (or in reality usually pension funds and other investment institutions) have lent money to the UK Government and in three years’ time will receive slightly less back than they loaned out. They are prepared to do this because of the security that lending money to the UK Government brings. Obviously, with interest rates now so low (base rate is 0.1%), such a deal, given the security it affords, is not as bad as it first appears. Nevertheless, this is the first Bond in the UK Government’s history that has been issued at a negative interest rate.

Furthermore, the new Governor of the Bank of England, Andrew Bailey, has also left open the option of reducing bank base rates even further, possible to less than zero. Readers may remember that in the 2008 financial crisis, the Bank of England pushed back against this idea, arguing that it would make banks and building societies unprofitable and could cause further problems for the banking system. These days, following much higher capital requirements over the last 10 years, banks are in a better position to withstand negative interest rates but there are still practical difficulties if that was to be implemented. The purpose of negative interest rates, which has been used in Japan and other countries, is to encourage spending and discourage saving, and thus keep money moving through the economy. It remains to be seen whether the Bank of England would go so far as this but the very fact that it is not ruling out the option demonstrates the extraordinary times we are currently living through.

I’ll finish with this thought – 2nd Quarter 2020 saw the one of the biggest GDP falls in UK history. The 3rd Quarter figures are likely to show one of the largest GDP growth figures in UK history. In the US, Payroll measurement company ADP previously reported almost 3 million jobs were lost in the United States in May. It has subsequently revised that figure to suggest that, in fact, 3 million jobs were created! And in the UK, millions of people will be returning to work, whilst sadly thousands of job losses will also be announced on an almost daily basis. One could almost feel sorry for Chancellor of the Exchequer Rishi Sunak as he tries to make sense of all this and take major policy decisions in these extraordinary times!

Please note these are the views of Christopher Charles Financial Services Ltd, and are for background information only. They do not constitute advice, nor should action be taken without specific advice, pertaining to individual circumstances. Investments can fall as well as rise in value, and you may not get back as much as you invested, particularly in the short term. E & O E – figures are produced with great care, but no liability whatsoever can be accepted for any errors of information within this document. Past performance is not a guide to the future. Christopher Charles Financial Services Ltd is authorised and regulated by the Financial Conduct Authority.

CCFS Ltd, The Dolls House, Teeton Road, Guilsborough, Northampton, NN6 8RB Phone: 01604 740022