01 Nov Investment Markets Update – November 2020

1st November 2020

Investment Markets Update

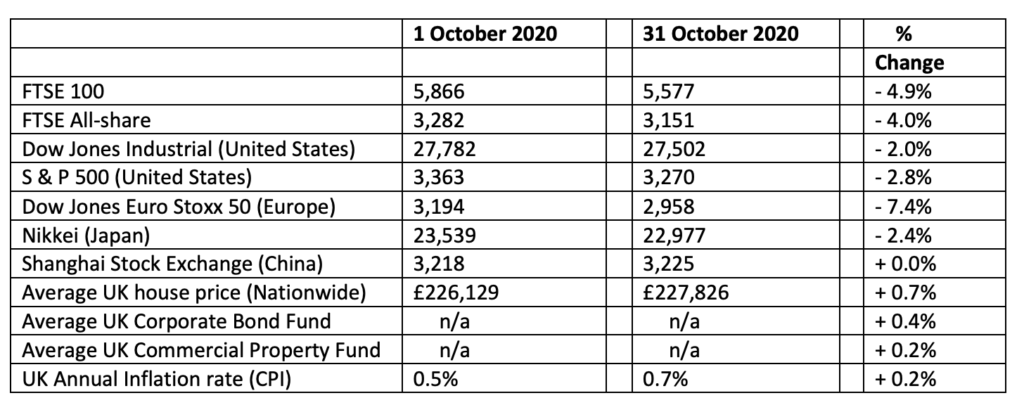

The figures:-

The reasons:-

The ghouls of Halloween hit world stock markets at the end of this month, with markets taking fright at the sight of a significant rise in COVID-19 cases again, across much of Europe and other parts of the world. We have seen countries in Europe and elsewhere re-imposing tighter restrictions and even full national lockdowns in an effort to stem the rapid rise in new cases each day. The Prime Minister here announced a national lockdown for one month, for England and which is likely to be copied in some forms of similar fashion throughout the rest of the United Kingdom also.

As a result of these measures, stock markets are fearful once again that the economies of the world are going to be hit badly and this sentiment makes the immediate future for markets look very uncertain.

1 November was to mark the start of the new Support scheme that the UK Government has brought in to replace the Furlough scheme that was to end the day before. However, that previous Furlough scheme has been extended for one more month, given the new lockdown in England. The great fear for the Government, and everyone else, is that unemployment in those sectors of the economy that have been badly hit by COVID-19 now rises in very large numbers, which would slow down the supply of money throughout the system and bring a further recession. I think this is almost inevitable now, I’m afraid.

Up until this month, we had been seeing in many sectors of the economy a significant “V” shaped recovery, something that I was hopeful was going to happen. However, such is the resurgence of the second wave of COVID-19 and subsequent restrictions being re-imposed, this is inevitably going to have a slowing effect and indeed brings risk of a double dip recession. Investment markets will likely be difficult in the short term.

Although the Covid problems are worldwide, UK stock markets still continue to fare worse than most this year. That’s partly as a result of the UKs traditionally high level of dividend payments to shareholders being hit by government pressure not to pay out to shareholders at the same time as taking government business support. Many large firms have reduced or suspended dividends completely for the time being, and share prices have dropped to reflect that.

Furthermore, although the Brexit trade deal discussions with the EU have largely been ignored by the media and public this year, as Covid has dominated all other news, it is nevertheless, an important issue and markets would welcome an announcement of a trade deal between the UK and EU, even if it only avoids tariffs and keeps transport between England and France going relatively smoothly.

Matters will certainly come to a head this month. If no deal is agreed then a further headwind will be imposed on the UK economy which, although dwarfed by the typhoon of Covid, would mean an even more difficult recovery for us next year. A Brexit deal would be welcomed by markets, which have already accepted that a “thin” deal is now the best they can hope for.

It’s interesting to note that Chinese and some other Emerging Markets have steadied, as Covid 19 cases peaked in China many months ago and have been reported ever since as at relatively low levels. The continental European markets, which had had a good run of recovery, had a tumultuous month, with the region locking down again in the face of the second wave of Covid, and markets falling accordingly.

Some comments of solace I might offer include the ongoing steady performance of the Bond market and the re-opening of some Commercial Property funds run within the open-ended structure, and which had been previously closed to trades for several months. I don’t think the commercial property market is out of the woods at all yet, but it’s good to see some semblance of normality returning to that area.

I would also point out that UK shares now look cheap. Whether that’s because they’re just unpopular due to the current dividend situation, and Brexit uncertainty and these low prices are temporary remains to be seen. If a UK/EU trade deal is agreed and if Covid can be brought under control relatively quickly, there is an argument to suggest UK shares could bounce back quickly. There’s a few “ifs” still in there however. Time will tell, but my fingers are crossed in optimism for now.

Jargon Buster – how much money is “lots and lots”?

So far, the Government has spent around £350bn since March on its support schemes, to keep the economy going whilst it imposed a close-down of many legitimate businesses, for health reasons. People are aware that the Government spending is massive but it is easy to get bemused by the talk of millions, billions and even trillions. I thought I would try to put the Government’s positon in some kind of perspective that may be easier to understand.

Let us imagine that Mrs Miggins earns £30,000 per year after taxes. She had a significant Financial Crisis just over 10 years ago as relatives overseas failed to repay some loans she had given them, and as a result of that she accrued further debts on her own credit cards, bringing the total debt up to around £25,000. She subsequently has spent the last decade trying to keep her spending down as low as possible. Furthermore, she was able to get some very good deals on those credit cards and currently is paying only around 1% in interest. Although she has brought her spending levels down, she was still spending around £32,000 a year on her £30,000 net salary. Last Christmas she decided that she had made enough effort to reduce her spending and would not make any further efforts. Instead she planned to do well at work, and in particular get extra new work in the North of England with the aim of increasing her income above her current £32,000 per year spending. She hoped therefore that at that point she would even to be in a position to pay off a little of those credit cards that have been hanging around for over 10 years.

Very unfortunately, and very unexpectedly, she was struck by a serious illness in March this year. In order to carry on working she has had to have medical treatment at a significant cost to herself and she had so far added a further £15,000 onto her credit cards. Again, she has been able to use introductory offers in order to keep the interest rates down to around 1% but her debt now stands close to £40,000. Her work that was going rather well now looks much more uncertain and her debts continue to rise. Her £30,000 income looks more likely to go down, rather than up for the next couple of years at least.

Mrs Miggins feels that she has no option but to carry on spending money on her medical treatment because if she does not, then she might die and default on her debts. She wishes to do neither. Therefore, like the desperate gambler at the roulette table in the small hours of the morning, she feels she cannot cut her losses. If she were to walk away now all that would be left is a pile of debts and nothing to show for it. Like that roulette player, she feels she has to carry on taking further bigger bets in order to recoup the losses and, hopefully, walk away at some point in the night at least breaking even.

But with debts already of almost £40,000, the continuing costs of medical treatment and the fear of unemployment in the future, Mrs Miggins is seriously concerned about her future. However her doctors have assured her that significant research is currently going on into her illness, and a cure may become possible, maybe even as early as next year. If that were the case, she might find herself well again, and able to continue her previous ambitions of employment and income, albeit now with a higher level of debt to manage.

And this is, in simple terms, the position that the UK Government finds itself in. Our Government is far from unique in this, with many other European countries such as France, Italy, Spain as well as the United States and other countries further afield in very similar situations themselves. They have come so far that to give up now feels almost impossible. And for this reason I think we will continue to see Government spending throughout the world on a scale never before seen in peacetime.

This will help the world economy in the short term, and provide some solace for stock markets, because there is still money moving around the system (much of that from Government). But, as there is no clear end game yet in sight and the reality is that we may see certain industries effectively closing completely – for some time at least – and thus we will see further pressures on investment markets during the rest of this year.

Please note these are the views of Christopher Charles Financial Services Ltd, and are for background information only. They do not constitute advice, nor should action be taken without specific advice, pertaining to individual circumstances. Investments can fall as well as rise in value, and you may not get back as much as you invested, particularly in the short term. E & O E – figures are produced with great care, but no liability whatsoever can be accepted for any errors of information within this document. Past performance is not a guide to the future. Christopher Charles Financial Services Ltd is authorised and regulated by the Financial Conduct Authority.

CCFS Ltd, The Dolls House, Teeton Road, Guilsborough, Northampton, NN6 8RB Phone: 01604 740022