04 May Investment Markets Update – May 2020

1st May 2020

Investment Markets Update

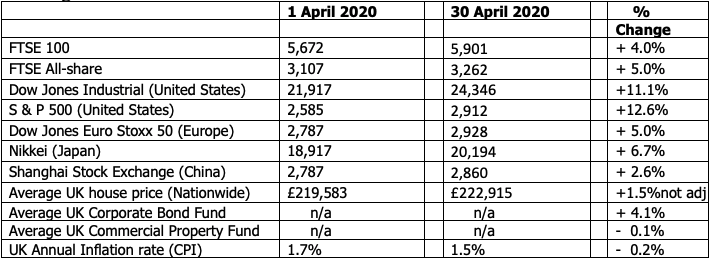

The figures:-

The reasons:-

After the total panic and meltdown within global stock markets during March, April saw a very welcome partial recovery. Indeed April 2020 proved to be one of the best months for investments in the US stock markets and certain other developed markets since 2002.

Although this by no means suggests that we are out of the woods yet, it does help settle, to some extent, investor’s nerves. Taking the FTSE 100 as an example, it reached a low point in the second half of March of 4,900 but in just over a month had gained over 20% and briefly tipped over the 6,000 point marker. It should be remembered that a fall of 20% will then require a gain of 25% just to end up at the same place. Given that the FTSE100 stock market fell by as much as 35% from the high points seen in early February to the lowest in later March (“peak-to-trough”), it then requires a gain of around 55% to take the FTSE100 back to the peak that we saw in February. Thus, although the 20% increase from the lowest point, including the 4-5% gains seen this month is welcome, you can see there remains much further to go.

One of the main reasons for the partial market recoveries that we have seen from those very low points so far has been the economic policies put in place by Governments in the UK, US and Europe. The UK Government response – in economic matters – has been generally regarded as very positive and timely. The support for private sector employees and businesses has been extremely strong. There will of course be an enormous bill at the end of all this and it will have to be debated as to how that bill will be divvied up and paid for (more taxation/more borrowing/higher inflation will be the options). But that is a problem for the future. The markets have also been pleased with the stimulus that the US Federal Reserve has put into place and, after some initial fumbling, the European Central Bank, working with EU countries, has put together a package of support too. Again, how the bill for all this will be paid for and divvied up between different EU countries will be an enormous row for the future but for the time being markets are pleased that businesses are not being allowed to fold hand over fist, but rather given support through these unprecedented times.

Furthermore, towards the end of the month we have seen quite a few countries starting to relax their lockdown rule, with certain businesses now becoming available to open again. Clearly this cheers the markets as companies will be able to trade and profits may be possible again too. The fear, of course, is that by reopening businesses and allowing the general public more movement and interaction, then a second wave of Coronavirus may sweep the general populations. If this happened, a tightening of lockdown rules would be inevitable and the damage to business even greater than at present.

For this reason, I think we should all be cautious in suggesting that the worst is necessarily behind us, both in terms of our lifestyles but also stock markets. The near-term future of certain industries, such as airlines, look distinctly bleak. I hope we have seen the bottom of the markets, but as I say this is not yet certain and we will need to watch carefully as to how the virus continues as countries gradually come out of lockdown.

One immediate concern to market values is the large number of companies that are already announcing cuts to dividends or even announcing that no dividend will be payable at all. A striking example is Shell, which has just announced a zero dividend for the first year since 1947. These reduced dividends particularly affects FTSE 100 companies, which typically pay higher levels of dividends. Many clients hold “UK Equity Income” funds, which are generally regarded as more secure ways for investors to engage with the UK stock markets. The attraction of Equity Income funds is of course the level of dividends, because large, mature businesses are less likely to see significant year on year share price growth in the manner that smaller companies might be able to do. If you strip out the attraction of the dividends then the capital values of those shares can be quite badly affected and we are seeing the effects of that in some of the Equity Income funds within our own portfolios. I suspect dividends will be lower for the rest of this year and probably quite well into next year too. This will be a big headwind for the FTSE 100, though probably not so much for the FTSE 250 companies (the next tier down), where dividends are not usually so large to begin with.

On the Bonds side of things, we again saw quite a good deal of recovery both in Corporate and Government Bonds as markets decided that bankruptcies (and therefore defaults on Bonds) will be less severe than at first feared. That said, I note that Italy has had its credit rating reduced by Fitch (one of the major credit rating companies) to yet another lower point. This reflects the position that Italy now finds itself in, technically bankrupt (it was already in an economic mess to start with) and being enclosed in the Eurozone currency, meaning that its former strategy, over several decades, of devaluing its Lira in order to remain competitive for its exports, is no longer an option to clear the mess. At some point there will have to be a decision made by the Eurozone countries as to whether there will effectively be outright transfers of money from the richer northern countries, such as Germany to the harder hit and poorer countries such as Italy and Spain. That is a fundamental issue within the Eurozone as it currently stands and promises to be an enormous argument to come.

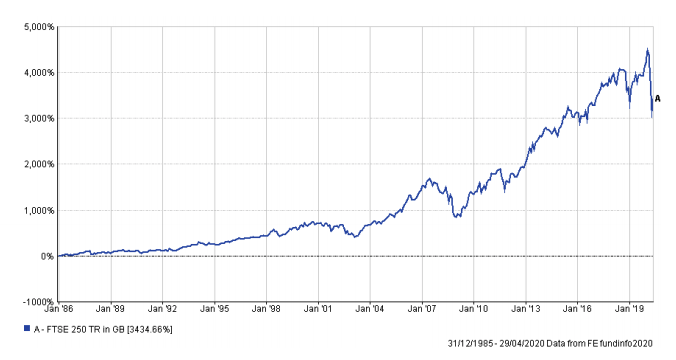

I would like to finish with a couple of reminders. Firstly the only secure asset to hold in terms of your capital is Cash. All other “real assets” carry risk to capital and can go down as well as up, particularly in the short term. All our readers are, of course, completely aware of this and also are aware that Cash is paying a very low return, and quite substantially below inflation. A feature of assets that can outstrip inflation, such as Equities and Bonds is that capital values can have short term fluctuations in either direction. Markets tend to be rational in the long term but irrational in the short term, with waves of panic and greed sometimes overwhelming them. We have seen that in the last couple of months with some of the worst falls for over 30 or 40 years in dispersed with some strong gains at times, including a record one day gain of almost 10% in UK markets. I thought it may help, again, for me to show the long term position of the FTSE 250 – the stock market index that measures the largest 101-350 companies in the UK. In my opinion this is a rather better barometer of UK PLC as it excludes the largest 100 companies who typically earn most of their profits from overseas markets. You can see from the graph below that despite the significant falls from Mid-February to the back-end of March (and the slight recovery since) the gains in the FTSE 250 since the index began in 1985 has been considerable.

If you were to draw a smooth line between the peaks and troughs, the steadily rising curve would be greatly appreciated by most investors. The problem is that it never is a continually smooth curve but has the jagged edges of a saw as markets move (sometimes irrationally) in the short term whilst finding a realistic valuation in the longer term. Sometimes, of course, short term falls are entirely rational if circumstances mean the outlook for business profits have gone down. That’s why Equities and Bonds are regarded as medium-longer term investments and are so greatly used in pension funds which by definition are longer term programs.

I think it helps to remember these basic points at times of severe market pressure and possibly of individual stress. It is also a useful reminder, particularly for those investors relying on drawing down funds for income, of the benefit of having a diversified portfolio of different asset types. Very often when Equities are falling, other assets such as Bonds, Cash or maybe even more esoteric investments, such as Gold, may be rising.

Jargon Buster – Keynesianism and Monetarism

I only have the space for a very brief summary of this topic, which has kept economists in endless debate for almost a century. However, given the recent UK government intervention with Business Grants, paid-for furloughing of private sector staff, and cheques (“checks”) for $1,200 being sent to every household in America ($2,400 for married couples) from the US government, it seems an appropriate time to mention this subject. Keynesianism (from John Maynard Keynes, an early 20th century economist) states – amongst many other things – that in a recession, government spending is required to create demand which in turn creates jobs, and avoids the high unemployment rates that would inevitably result otherwise. If people cut back their spending in recession, preferring to be careful and save, then that has a knock-on effect on other people, who see their income fall, and they in turn cut back and so on, in a vicious circle. Keynes theory says Governments must step in with spending to break that cycle, keep employment up and accept that inflation will rise (the so-called Phillips Curve).

Monetarists (such as Milton Friedman, who argued against Keynesianism) believe in controlling the flow of money that goes into an economy, and leaving the market to fix itself. We saw examples of this with the “Austerity policies” from 2010, when government spending was tightly reigned in so as to “balance the books” between government expenditure and income. Monetarists tend to see little long-term value in state intervention in many parts of the economy as they see it as artificial and will result in a less efficient economy in the long term, and leaving high government debt that will slow down future economic growth.

In UK politics, we saw in the last decade Labour argue that Austerity was making a bad situation worse. By cutting back on government spending after the 2008-09 financial crises, inflation remained low, but so did economic growth. Unemployment actually remained low too (not always the top priority of monetarism in the short-term) but so did wages, despite Minimum Wage laws. In response we saw David Cameron for the Conservatives argue that Labour had spent too much “when the sun was shining”, i.e. government spending had been too high from 2001-2008 when the economy was doing well, and leaving no room for further spending in the recession that followed. A country that ends up in huge debt risks high borrowing costs and/ or high inflation and/or going bust.

Both arguments have their strengths and weaknesses, hence the perennial arguments between economists as well as politicians as to how to best run an economy. What is striking at this time though is how the Conservative government has responded to the Coronavirus crises. It has argued that because the State has ordered the closure of so many businesses (on public health grounds) the State has a moral duty to cover those costs, and has embarked on what I described last month as “Keynesianism on steroids”. It is the antithesis of usual Conservative policy, and yet the rationale has been accepted by its own supporters and left its political opponents with no real option but to broadly support the government’s economic response. This sudden shift of public policy to Keynesianism for the first time in many decades is just another example of how unusual life has become at this time.

Please note these are the views of Christopher Charles Financial Services Ltd, and are for background information only. They do not constitute advice, nor should action be taken without specific advice, pertaining to individual circumstances. Investments can fall as well as rise in value, and you may not get back as much as you invested, particularly in the short term. E & O E – figures are produced with great care, but no liability whatsoever can be accepted for any errors of information within this document. Past performance is not a guide to the future. Christopher Charles Financial Services Ltd is authorised and regulated by the Financial Conduct Authority.

CCFS Ltd, The Dolls House, Teeton Road, Guilsborough, Northampton, NN6 8RB Phone: 01604 740022