01 Dec Investment Markets Update – December 2020

1st December 2020

Investment Markets Update

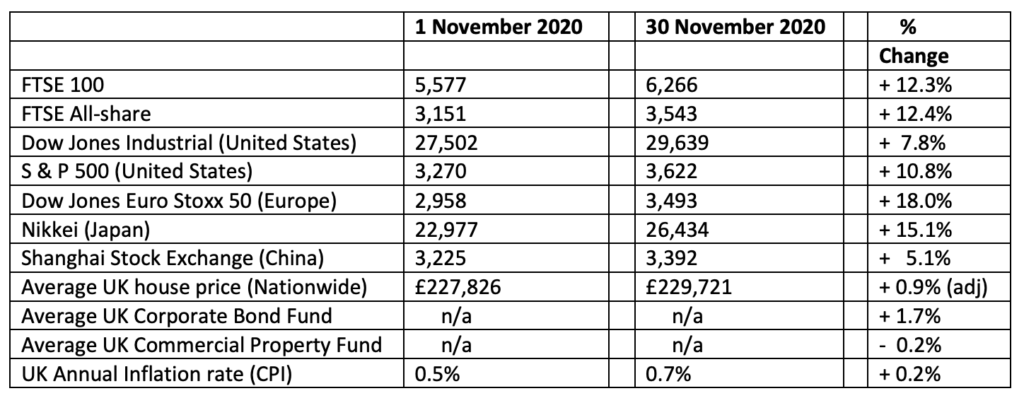

The figures:-

The reasons:-

I finished last month’s update, which had been describing the very poor returns of October with a final comment – “If a UK/EU Trade Deal is agreed and if COVID can be brought under control relatively quickly, there is an argument to suggest UK shares could bounce back quickly.”

So, you wait all year for a COVID vaccine and then three come along all at once. On three consecutive Mondays during the month, announcements were made by Pfizer/BioNTech, Moderna and AstraZenica/Oxford, each of them announcing impressive success rates for their new vaccine against COVID-19. Markets globally were cheered enormously by these announcements. Although the immediate economic problems caused throughout this year by COVID-19 remain just as great as ever, there is now real light at the end of the tunnel and markets can see how prospects for 2021 can be significantly better than those we have endured this year.

Those markets which have suffered the most this year have now benefited most greatly from this bounce back in confidence and optimism. As we have discussed several times, the UK market has been hit particularly hard due to its reliance on the services sector and the further uncertainty of the trade negotiations with the European Union. We have been an unloved market for some time now. Furthermore, the largest UK companies, which traditionally pay a very high level of dividend compared to most of the rest of the world, were particularly hard hit when dividends were cut, sometime quite significantly, during this year. The new found optimism as a result of the vaccine has benefited these areas particularly.

Indeed, November 2020 was the highest returning month for the FTSE 100 since 1989 (Margaret Thatcher was still the Prime Minister and the Berlin Wall was being dismantled). European markets were also significantly up in November, bettering the returns of both the United States and the Emerging Markets – areas of the world where stock markets have not been hit as hard to date.

There was another event important to the world last month in that Joe Biden was voted President of the United States, albeit not yet fully recognized by its current incumbent Donald Trump. Like many commentators, I think the effect to us here in the UK will not be especially huge and nor do I think it will impact enormously on world stock markets generally. Nevertheless, I think it is fair to say the President-elect Biden is likely to be more interested in the battle against climate change and will join in global efforts in a way that the United States have not done over the last four years. He is also, in my opinion, less likely to pick trade arguments with China, and certainly less likely to send midnight Tweets threatening immediate tariffs etc., and sending the stock markets down whilst we sleep. Few of us will miss those mornings waking up to learn the Chinese stock prices had suddenly fallen 5% whilst we slumbered.

The likely position (to be concluded by two run-off votes in January) is that the Senate will remain with a Republican majority even if the House of Representatives have turned Democrat. As a result, I do not foresee significant tax rises for corporate America (Mr Biden is not known to be anti-business in any event) and thus the stock markets have taken a generally positive attitude to the election results. And, given the boost, so to speak, of the vaccine news, it was very much a “Risk-On” month for markets generally with the Bond markets being particularly positive in the higher yield area. The more risk the Bonds were taking, the more valuable they became as markets took the view that the risk of defaults would now be falling given the (hopefully) end in sight of COVID-19.

Jargon Buster – short selling

Investors want to buy low and sell high, right? Well, usually – but not always. Sometimes an investor – or investment fund – takes a bet that a company share price will fall. If that happens, the investor makes a gain; if the share price doesn’t fall, the investor loses their money.

This investment technique is known as “short selling” or “shorting”. It can be a risky transaction, although when used in certain circumstances, it can be a prudent and costeffective way to de-risk a portfolio.

At its riskiest, an investor / fund thinks the market or a specific share is about to fall and using an instrument known as a Derivative, takes a bet on that eventuality. It can make them money even if shares are falling. However, if this bet is taken in isolation, and the shares go up in value, then losses might be significant, depending on the terms of the trade. This “naked position” carries significant risks, and is generally not for individual investors or indeed many professionally managed investment funds. You can see a similar concept however in use by “spread-bet” companies – sometimes resulting in catastrophic losses for individuals not understanding the potential extent of their losses (78% of spread-bet private accounts lose money by the way).

Using a Derivative in a “covered position” however, can be entirely sensible and reduces risk. For instance, an investment fund may own a large quantity of Apple shares. The fund manager believes they are a good long-term holding but for specific reasons s/he thinks the share price will not move much in the near future, or maybe even fall. They don’t want to sell the shares (because of the long term prospects) and indeed if the holding is very large the act of selling them could push the share price down by itself.

So, if the fund manager shorts their own stock – i.e. bets their own shares will fall, so then they’re covered both ways. Should Apple stock fall in value, the Short will pay out to cover the loss of the shares being held. If Apple shares go up, then the money used to buy that Derivative is lost, but the gain in the share price of the stock still held will cover that. In essence, it neutralises the portfolio position in the short term – a position a fund manager will accept if their personal belief is that, if left alone, the portfolio would fall.

In footballing terms, a covered short is like parking the bus in front of the goal and playing for a 0-0 draw. If you’re playing Liverpool away on a wet Tuesday night in February, you’d probably take that result.

Please note these are the views of Christopher Charles Financial Services Ltd, and are for background information only. They do not constitute advice, nor should action be taken without specific advice, pertaining to individual circumstances. Investments can fall as well as rise in value, and you may not get back as much as you invested, particularly in the short term. E & O E – figures are produced with great care, but no liability whatsoever can be accepted for any errors of information within this document. Past performance is not a guide to the future. Christopher Charles Financial Services Ltd is authorised and regulated by the Financial Conduct Authority.

CCFS Ltd, The Dolls House, Teeton Road, Guilsborough, Northampton, NN6 8RB Phone: 01604 740022